Valeant Pharmaceuticals stock (VRX) continued its slide, as news of an SEC investigation fueled additional selling on Monday. The embattled drug company's stock has been trending lower for several months now.

VRX ended the day down 18% on volume of 27 million shares, triple its recent average daily volume. After a huge run up from 2009 to mid-2015, VRX began showing signs of topping and distribution (selling by major holders) in the fall of 2015. The stock is down 35% year-to-date in 2016 and down 67% over the past year (Finviz stats, click chart below).

Let's take a look at the charts and examine the troubled stock's downtrend, and the huge uptrend that preceded it. I'll also offer some ideas on how to avoid major stock declines (or at least limit your losses in such instances).

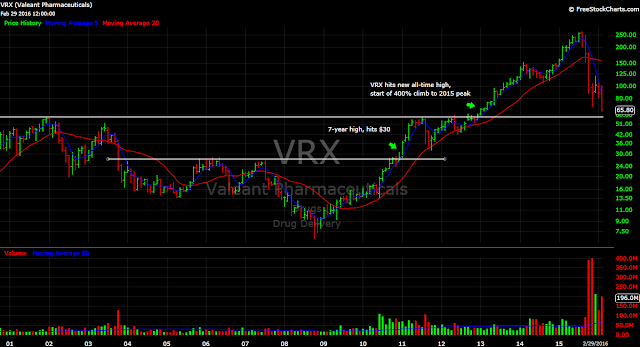

Below, the multi-year consolidation pattern that launched VRX's 2010-2015 advance. The stock would climb from $23 to over $250 in that 5-year period.

While VRX started off 2015 on a very strong note (+39% YTD at this time last year), the stock topped in late summer above $250 and began to sell off in late September and October 2015. By late October, the selloff had consumed all of VRX's gains since September 2013. Two years of gains were wiped out in 2 months.

Looking back at VRX's decline from October 2015, I shared the following chart on Twitter. You can see the stock's slide began with a sharp drop in August 2015 that tested its 200 day moving average. VRX then broke through its 200 day MA on significant volume in late September 2015. By late October, the stock was down 50% from its September levels.

Here's the latest price chart of VRX with updated annotations. An attempted rebound in late 2015 turned into a long sideways move, with a recent selloff to new 3-year lows. As of today, VRX is down 75% from its 2015 high.

Some major hedge funds and mutual funds have taken quite a hit from VRX's plunge. Among them, Bill Ackman's Pershing Square Capital, John Paulson's Paulson & Co., Brahman Capital, Sequoia Fund, and Nehal Chopra's Tiger Ratan (Chopra is one of Julian Robertson's younger "Tiger Cubs"). In fact, VRX was one of the most widely owned stocks in the hedge fund community in 2015, and as Bloomberg pointed out, many got burned.

Now what does that mean for those of us who are small investors and independent traders, rather than hedge fund billionaires? We are (mostly) looking after our own money, so ultimately we are responsible for our results and the preservation of our capital. How do we prevent ourselves from being burned in such a downtrend?

How to avoid disastrous stock declines (a few thoughts and ideas):

1. Avoid falling in love with a company or its stock. The emotional attachment will cloud your judgement and prevent you from making sound decisions in the market. The "pet stock" phenomenon occurs more often than you may think. See my recent Tesla post for more on this.

2. Are you a long-term fundamental investor or a price-based trader? Know your methodology and your reason for getting into a trade or a particular investment. As the saying goes, it's often easier to buy a stock than to know when to sell it. It's even more difficult to exit a losing position when you begin shifting strategies late in the game. The recent market decline has turned many once-confident "bargain hunters" into panicked sellers.

3. Use a simple moving average to guide your selling decisions. For example (and this is a rough guide, not a foolproof method), you may decide to sell once your stock closes below its 200 day moving average. Or you may decide to sell when the stock breaches a prior support level. Stocks go through a life cycle of boom and bust (see Stan Weinstein's stage analysis). You want to ride the uptrends and, ideally, sell near tops or in the early stages of a downtrend. If you can clearly differentiate between the accumulation and distribution phases of a stock's life cycle, it will help guide your buy and sell decisions.

4. If trading off charts isn't your thing, at least limit your losses to 10% or 15%. Predetermined loss limits can help you take the emotion out of selling. Smaller losses make it easier to get back in the game. Large losses require huge, ever-increasing gains to make it back to your break-even point.

5. Don't add to your losing trades in an effort to "average down" at a lower price. While you may see many big-name investors do just that, remember that they are often playing with other people's money (or taking big risks with their own capital). This is a strategy that can lead to ruin, especially when an investor becomes convinced that their favorite stock is now "cheap" or has been unjustly punished by the market. Remember, "cheap" can get much cheaper than you imagined. Billionaires can usually regroup after a $100 million mistake. What will happen to you if you lose $100 thousand?

6. Study charts of stocks that had similar boom and bust cycles. Many leading stocks have been pummeled in bear markets or lost most of their value once their high-growth phase petered out. If you study enough of these charts, you'll begin to see warning signs that may help you avoid future declines. William O'Neil's books are a great resource in this area.

Related articles and posts:

1. Tesla Shares Slide to New Low: TSLA Chart Review.

2. Paul Tudor Jones on Trading and Risk Management.

3. Round Trip Stocks: Momentum Booms and Busts.

4. Crash at ASPS and OCN: Early Warning Signs.

Subscribe to Finance Trends by email or get new posts via RSS. You can follow our real-time updates on Twitter.

VRX ended the day down 18% on volume of 27 million shares, triple its recent average daily volume. After a huge run up from 2009 to mid-2015, VRX began showing signs of topping and distribution (selling by major holders) in the fall of 2015. The stock is down 35% year-to-date in 2016 and down 67% over the past year (Finviz stats, click chart below).

Let's take a look at the charts and examine the troubled stock's downtrend, and the huge uptrend that preceded it. I'll also offer some ideas on how to avoid major stock declines (or at least limit your losses in such instances).

Below, the multi-year consolidation pattern that launched VRX's 2010-2015 advance. The stock would climb from $23 to over $250 in that 5-year period.

While VRX started off 2015 on a very strong note (+39% YTD at this time last year), the stock topped in late summer above $250 and began to sell off in late September and October 2015. By late October, the selloff had consumed all of VRX's gains since September 2013. Two years of gains were wiped out in 2 months.

$VRX started 2015 strong. Now in midst of sharp decline (-19% today), has erased year's gains. pic.twitter.com/2E8w2ZxEOb— Finance Trends (@FinanceTrends) October 21, 2015

Looking back at VRX's decline from October 2015, I shared the following chart on Twitter. You can see the stock's slide began with a sharp drop in August 2015 that tested its 200 day moving average. VRX then broke through its 200 day MA on significant volume in late September 2015. By late October, the stock was down 50% from its September levels.

$VRX notes: See the volume buildup in September as stock tested & broke through 200 day Moving Avg. Now 50% lower. pic.twitter.com/bZvF8rdHI6— Finance Trends (@FinanceTrends) October 22, 2015

Here's the latest price chart of VRX with updated annotations. An attempted rebound in late 2015 turned into a long sideways move, with a recent selloff to new 3-year lows. As of today, VRX is down 75% from its 2015 high.

Some major hedge funds and mutual funds have taken quite a hit from VRX's plunge. Among them, Bill Ackman's Pershing Square Capital, John Paulson's Paulson & Co., Brahman Capital, Sequoia Fund, and Nehal Chopra's Tiger Ratan (Chopra is one of Julian Robertson's younger "Tiger Cubs"). In fact, VRX was one of the most widely owned stocks in the hedge fund community in 2015, and as Bloomberg pointed out, many got burned.

Now what does that mean for those of us who are small investors and independent traders, rather than hedge fund billionaires? We are (mostly) looking after our own money, so ultimately we are responsible for our results and the preservation of our capital. How do we prevent ourselves from being burned in such a downtrend?

How to avoid disastrous stock declines (a few thoughts and ideas):

1. Avoid falling in love with a company or its stock. The emotional attachment will cloud your judgement and prevent you from making sound decisions in the market. The "pet stock" phenomenon occurs more often than you may think. See my recent Tesla post for more on this.

2. Are you a long-term fundamental investor or a price-based trader? Know your methodology and your reason for getting into a trade or a particular investment. As the saying goes, it's often easier to buy a stock than to know when to sell it. It's even more difficult to exit a losing position when you begin shifting strategies late in the game. The recent market decline has turned many once-confident "bargain hunters" into panicked sellers.

3. Use a simple moving average to guide your selling decisions. For example (and this is a rough guide, not a foolproof method), you may decide to sell once your stock closes below its 200 day moving average. Or you may decide to sell when the stock breaches a prior support level. Stocks go through a life cycle of boom and bust (see Stan Weinstein's stage analysis). You want to ride the uptrends and, ideally, sell near tops or in the early stages of a downtrend. If you can clearly differentiate between the accumulation and distribution phases of a stock's life cycle, it will help guide your buy and sell decisions.

4. If trading off charts isn't your thing, at least limit your losses to 10% or 15%. Predetermined loss limits can help you take the emotion out of selling. Smaller losses make it easier to get back in the game. Large losses require huge, ever-increasing gains to make it back to your break-even point.

5. Don't add to your losing trades in an effort to "average down" at a lower price. While you may see many big-name investors do just that, remember that they are often playing with other people's money (or taking big risks with their own capital). This is a strategy that can lead to ruin, especially when an investor becomes convinced that their favorite stock is now "cheap" or has been unjustly punished by the market. Remember, "cheap" can get much cheaper than you imagined. Billionaires can usually regroup after a $100 million mistake. What will happen to you if you lose $100 thousand?

6. Study charts of stocks that had similar boom and bust cycles. Many leading stocks have been pummeled in bear markets or lost most of their value once their high-growth phase petered out. If you study enough of these charts, you'll begin to see warning signs that may help you avoid future declines. William O'Neil's books are a great resource in this area.

Related articles and posts:

1. Tesla Shares Slide to New Low: TSLA Chart Review.

2. Paul Tudor Jones on Trading and Risk Management.

3. Round Trip Stocks: Momentum Booms and Busts.

4. Crash at ASPS and OCN: Early Warning Signs.

Subscribe to Finance Trends by email or get new posts via RSS. You can follow our real-time updates on Twitter.