Facebook (FB) stock is at a new all-time high following its latest earnings report.

Meanwhile, Twitter (TWTR) shares gapped lower this week after another lackluster quarterly earnings report.

To revisit a theme from my previous Facebook vs. Twitter posts, this is a prime example of why you want to buy strength and avoid (or sell) weakness in the stock market. FB, the strong stock, continues to trounce its weaker rival TWTR in terms of relative stock performance.

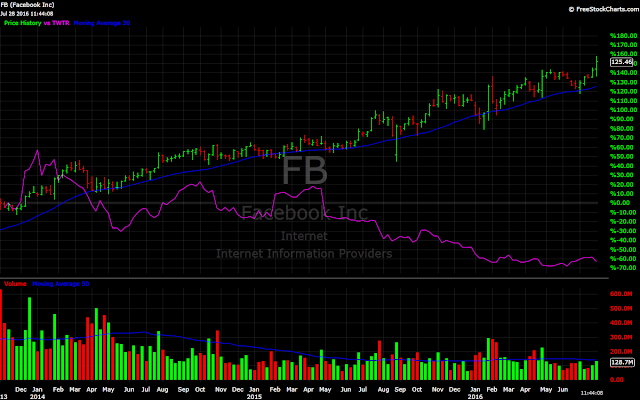

Witness the latest FB vs. TWTR performance chart. Since its IPO in late 2013, TWTR (shown in purple) has declined by 61 per cent (-61%). In that same time frame, FB is up 151 per cent (151%).

Looking back, which stock would you have rather owned? Of course, hindsight is 20/20, so I'll remind you that this trend towards Facebook's social media and stock market dominance was taking shape (and documented here in real-time) back in 2014 and 2015.

Please see the following posts:

1. Twitter's Big Year: TWTR 2014 in Charts.

2. Facebook vs. Twitter: FB Shares Outperform TWTR.

While I have been an avid user of Twitter since 2009, I have never owned the stock. I have owned Facebook shares in the past, despite never having used the service (in fact, I can't stand Facebook).

Why? Because I am a trader who prefers to buy stocks in uptrends. That means I want a stock that will continue to move higher. I want to own stocks that are being bought by professional investors and are increasingly being discovered by the wider investing public.

Conversely, I want to avoid stocks that are being sold by these same groups of investors. When the stock chart shows signs of deterioration and increased selling, or the trend is clearly to the downside, I want to sell (or avoid) the stock and move on. Then I keep my money in cash or look for a stronger stock (preferably one in a new uptrend) to buy.

While other investors may follow a different approach, like buying stocks at or near new lows, I find that this is what works best for me. If you are struggling in the stock market, try to study the characteristics of winning stocks.

Focus on strong stocks in clear uptrends and sell losing stocks that hamper your overall performance. Over time, you will move towards increasing your exposure to these strong stocks while limiting your exposure to the laggards.

Subscribe to the free Finance Trends Newsletter. You can follow our real-time updates on Twitter.

Meanwhile, Twitter (TWTR) shares gapped lower this week after another lackluster quarterly earnings report.

To revisit a theme from my previous Facebook vs. Twitter posts, this is a prime example of why you want to buy strength and avoid (or sell) weakness in the stock market. FB, the strong stock, continues to trounce its weaker rival TWTR in terms of relative stock performance.

Witness the latest FB vs. TWTR performance chart. Since its IPO in late 2013, TWTR (shown in purple) has declined by 61 per cent (-61%). In that same time frame, FB is up 151 per cent (151%).

Looking back, which stock would you have rather owned? Of course, hindsight is 20/20, so I'll remind you that this trend towards Facebook's social media and stock market dominance was taking shape (and documented here in real-time) back in 2014 and 2015.

Please see the following posts:

1. Twitter's Big Year: TWTR 2014 in Charts.

2. Facebook vs. Twitter: FB Shares Outperform TWTR.

While I have been an avid user of Twitter since 2009, I have never owned the stock. I have owned Facebook shares in the past, despite never having used the service (in fact, I can't stand Facebook).

Why? Because I am a trader who prefers to buy stocks in uptrends. That means I want a stock that will continue to move higher. I want to own stocks that are being bought by professional investors and are increasingly being discovered by the wider investing public.

Conversely, I want to avoid stocks that are being sold by these same groups of investors. When the stock chart shows signs of deterioration and increased selling, or the trend is clearly to the downside, I want to sell (or avoid) the stock and move on. Then I keep my money in cash or look for a stronger stock (preferably one in a new uptrend) to buy.

While other investors may follow a different approach, like buying stocks at or near new lows, I find that this is what works best for me. If you are struggling in the stock market, try to study the characteristics of winning stocks.

Focus on strong stocks in clear uptrends and sell losing stocks that hamper your overall performance. Over time, you will move towards increasing your exposure to these strong stocks while limiting your exposure to the laggards.

Subscribe to the free Finance Trends Newsletter. You can follow our real-time updates on Twitter.